Launching the Crisis Management Investment Mathematical Task Force: Implementing Fixed Accountability

- kanna qed

- 1月7日

- 読了時間: 3分

The purpose of this Task Force is not to achieve zero accidents. Instead, it is to build and deploy an operational structure that prevents organizational decision-making from stalling—a state we call Explanation Hell—by ensuring that accountability cannot be shifted after the fact (Fixed Accountability). Here, ‘fixed’ means the decision basis and evidence are locked for re-computation—not that people are monitored.

This article serves as the official announcement of the Task Force's launch. For the detailed logical framework supporting this initiative, please refer to the three previously published foundational articles (Basic Specifications).

1. Prerequisites: Basic Specifications for Crisis Management Investment

The activities of the Task Force are based on the following three logical pillars. We recommend reviewing these prerequisites first:

The Ground Zero of Crisis Management Investment: Fixed Accountability Definition: A crisis is not the accident itself, but the state in which accountability can be rewritten after the fact. [Link to Article 1]

Why Crisis Management is Growth Investment: Ending Explanation Hell Effect: By fixing the decision record and minimizing post-accident explanation costs, organizations can increase their decision-making velocity. [Link to Article 2]

What is Crisis Management Investment? Fixed Accountability is a Shield, Not Surveillance Clarification:Fixing the decision record is not a tool for constraining the front lines, but a shield to protect both the front lines and decision-makers from post-hoc criticism. [Link to Article 3]

2. Mission: Implementing Fixed Accountability

Our mission is to translate the abstract concept of accountability into a mathematical operation through the following three elements:

Standard ID: Fixing which standard, threshold, or policy was used as the basis for a decision.

Evidence Chain: Fixing the chain of evidence and data that led to the decision.

Verify (Re-computation): Guaranteeing that any third party can reach the exact same conclusion using the same standards and evidence.

The Task Force serves as a hub for integrating this minimum mechanism of Fixed Accountability into actual business processes and system designs.

3. Guiding Policy: A Shield for the Front Lines

The most critical principle of the Task Force is that we do not promote surveillance.

What we fix is the rewritable explanation, not the individual in the field.

Instead of crushing exceptions and causing organizational timidity, we fix exceptions as facts to be passed forward, ensuring that improvement does not stop.

By adhering to this policy, we create an environment where decision-makers who take risks are not penalized by post-hoc narrative building.

4. Three Core Projects: The Front Line of Mathematical Solutions

Under the Mathematical Task Force for Crisis Management Investment, three primary projects are currently underway:

4-1. AI Accountability Project

Applying the triad of Standard ID x Evidence Chain x Verify to AI inference processes to physically stop the post-incident explanation sprawl in AI operations. We aim to drop a mathematical anchor of Fixed Accountability into the black box of AI operations.

4-2. Quantum Practicality Verification Lab

Translating highly complex and difficult-to-verify claims in the realm of quantum technology into a framework of mathematical verification that can be re-computed by third parties. We accelerate the process toward practical application by avoiding stagnation in investment decisions caused by unverifiable claims.

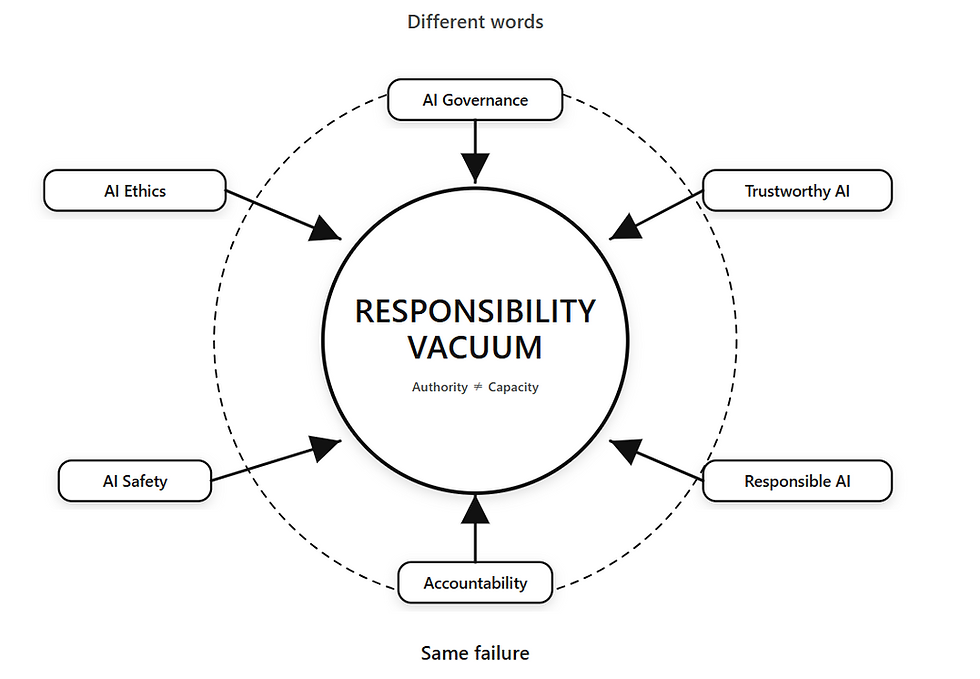

4-3. The Boundary Line Project between Science and the Humanities (AI and Responsibility)

Analyzing phrasing that causes accountability to evaporate and systems that blur responsibility, then translating them into language that can be mathematically fixed. This is an attempt to connect insights from the humanities to governance design through mathematical modeling.

5. The Fixed Mechanisms Provided by the Task Force

We do not provide temporary countermeasures; we provide fixed mechanisms that ensure decision-making does not stop.

Exception Ticket: A system that turns exceptional judgments into valid inputs for improvement (Minimum items: Standard/Policy ID, Exception Statement, Evidence Chain, Decision, Verify Procedure, Signature, Timestamp).

Standard-tagged Change Logs: Operational procedures to mathematically lock the reasons for changes in thresholds or policies.

Verifiable Audit Logs: Log designs that complete Fixed Accountability through computation rather than narratives.

Implementing these mechanisms allows an organization’s Approval Lead Time to remain at normal levels even after an incident. Specifically, we set a KPI to return the Approval Lead Time (from proposal to final approval) after a major incident from the pre-implementation 30–90 days to 5–10 days.

6. Conclusion

Crisis Management Investment must not be limited to equipment investment or the strengthening of surveillance systems.

The most important step is to first lay a foundation of Fixed Accountability within the decision-making layer—the core of the organization. Only then can all other investments realize their full potential.

This concludes the official announcement of the launch of the Mathematical Task Force for Crisis Management Investment.

[For inquiries or consulting requests: URL/Email]

GhostDrift Mathematical Institute (GMI)

コメント